Understanding Balancer: The Flexible Building Block for Programmable Liquidity

Balancer is a DeFi protocol that provides liquidity infrastructure. You can build new, innovative liquidity pools and financial dApps on Balancer.

What is Balancer?

Who is Balancer useful for?

Why should I build on Balancer?

Batch Swaps, Flash Swaps, and Flash Loans

Let’s dive right in.

What is Balancer?

Balancer is a DeFi platform that offers a flexible building block for programmable liquidity. Balancer powers AMMs (Automated Market Makers) on the main EVM networks (Ethereum, Polygon, Arbitrum, Optimism, Fantom).

Balancer stands out thanks to its architecture. On Balancer, AMM pricing logic and math are handled independently from token accounting and management. This is accomplished by the Vault. The Vault contract manages the tokens from every Balancer pool. Consequently, builders can implement custom pricing logic and math without worrying about low-level token management and security. The Vault architecture also passes on reduced gas costs for users and enables efficient multi-step swaps (batch swaps) out of the box.

The flexibility of Balancer allows a diverse ecosystem of liquidity pools and AMM products to co-exist and reinforce one another. Examples include:

Weighted pools allow users to limit their exposure to different assets in a liquidity pool. Instead of limiting depositors to 50/50 pairs, Balancer enables the creation of multi-token pools with custom weight parameters (e.g., 80/20, 60/20/20). This enables depositors to choose their exposure to different tokens in a pool. Swap fees can also be fully customized: high volatility pools usually have higher fees while low volatility pools have lower fees.

Liquidity Bootstrapping Pools are built to facilitate fair token launches. They are designed to disincentivize whales, bots, front-running, and speculation. They allow projects to define custom bonding curves that adjust over time. Projects that use LBPs can bootstrap liquidity with minimal investment. To get an idea of the potential of LBPs, Merit Circle raised an incredible $105,576,956 over the course of 72 hours using a Balancer Liquidity Bootstrapping Pool.

Boosted Pools are built to deliver high capital efficiency to LPs by enabling idle liquidity to be lent to external protocols. Typically, only up to 10% of the total pool liquidity is being utilized by swappers. This is because the average swap size and volume are much smaller than the total available liquidity at any given time. Boosted pools take advantage of this fact to offer depositors an opportunity at even greater returns.

Composable Stable Pools allow swappers to make significantly larger trades before encountering substantial price impact. Composable Stable Pools are nested, which means that they contain pool tokens as part of their pool. This defragments liquidity and saves users gas by allowing them to exit and join pools via the swap() function instead of the more expensive joinPool() and exitPool() functions.

Custom Pools are ideal for any team developing custom trade equations and strategies.

Since Balancer is permissionless, anyone can develop their own custom pool type and integrate it into the protocol. Some notable examples include Time-Weighted Average Market Makers (TWAMMs) developed by Cron Finance, the stablecoin design of Gyroscope, fixed-rate yield markets as developed by Element Finance, and AMM-powered remittance services (Xave).

Who is Balancer for?

Whether you’re an LP, swapper, or developer, Balancer has something to offer.

Developers: Improve your time to market by using Balancer’s secure building blocks

LPs: Make your liquidity work for you, provide liquidity and collect swap fees and BAL incentives

Swappers: Swap tokens safely for better rates across the entire Balancer ecosystem

Arbitrageurs: Perform Flash Loans with no fees having at your disposal the liquidity of the whole Balancer Vault

Why Should I Build on Balancer?

Balancer provides developers with secure DeFi infrastructure. Builders can focus on what differentiates their product/protocol. Balancer handles low-level token accounting, gas optimizations, and top-notch infrastructure security. This allows builders to ship faster, cheaper, and, most importantly, securely.

Building on Balancer can provide other important advantages, such as concentrated liquidity, streamlined integration with leading liquidity aggregators, and inclusion in the Balancer SDK, the SOR (Smart Order Router), and the Balancer Subgraph. Even more, teams building on Balancer can benefit from active support from different service providers in the Balancer ecosystem in areas like software development, marketing, and business development.

Batch Swaps, Flash Swaps, and Flash Loans

Batch swaps allow swappers to be positioned to get the best possible rates by efficiently accessing every Balancer pool's liquidity. This is useful when getting the best rate requires performing multiple swaps. With other protocols, you would pay gas for sending tokens at every step. However, with Balancer, since all the tokens are in the Vault contract, you only need to make a single function call where tokens are transferred only between you and the Vault.

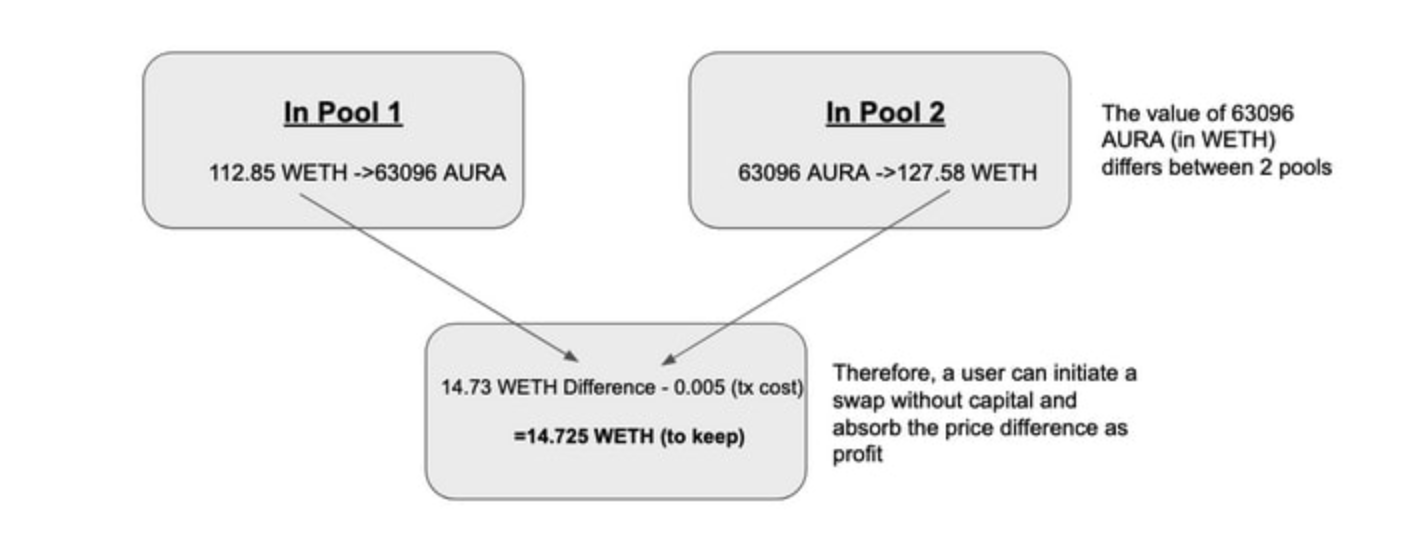

You can execute a Flash Swap if you discover an arbitrage opportunity in two Balancer Pools. You don’t need to hold any tokens to take advantage of it. You can use the Vault’s liquidity to make such trades without paying a fee while keeping all the profit. Anyone who identifies a price discrepancy in two Balancer Pools can freely take advantage of it.

Fig1: A Flash Swap in Practice (Etherscan)

You can even use Flash Loans for arbitrage opportunities across the whole DeFi ecosystem. Arbitrageurs who use Balancer’s Flash Loans have the unique advantage of having access to the entire Balancer’s liquidity while paying no fees for the Flash Loan.

Closing Thoughts

In summary, Balancer is a DeFi platform that provides liquidity infrastructure that helps accelerate innovation. Whether you're a developer, liquidity provider, swapper, or arbitrageur, you can take advantage of Balancer’s unique features.

As a developer, you can benefit from secure DeFi infrastructure, enabling you to focus on building innovative DeFi applications while Balancer handles low-level token accounting and gas optimizations. To begin building on Balancer, check out the documentation at docs.balancer.fi and learn more about how to get started.

This article is for informational and educational purposes only, and should not be construed as investment or trading advice or a solicitation or recommendation to buy, sell, or hold any digital assets. Transactions on the blockchain are speculative. Carefully consider and accept all risks before taking action.